It’s about time that I properly laid out the eight foundational health habits.

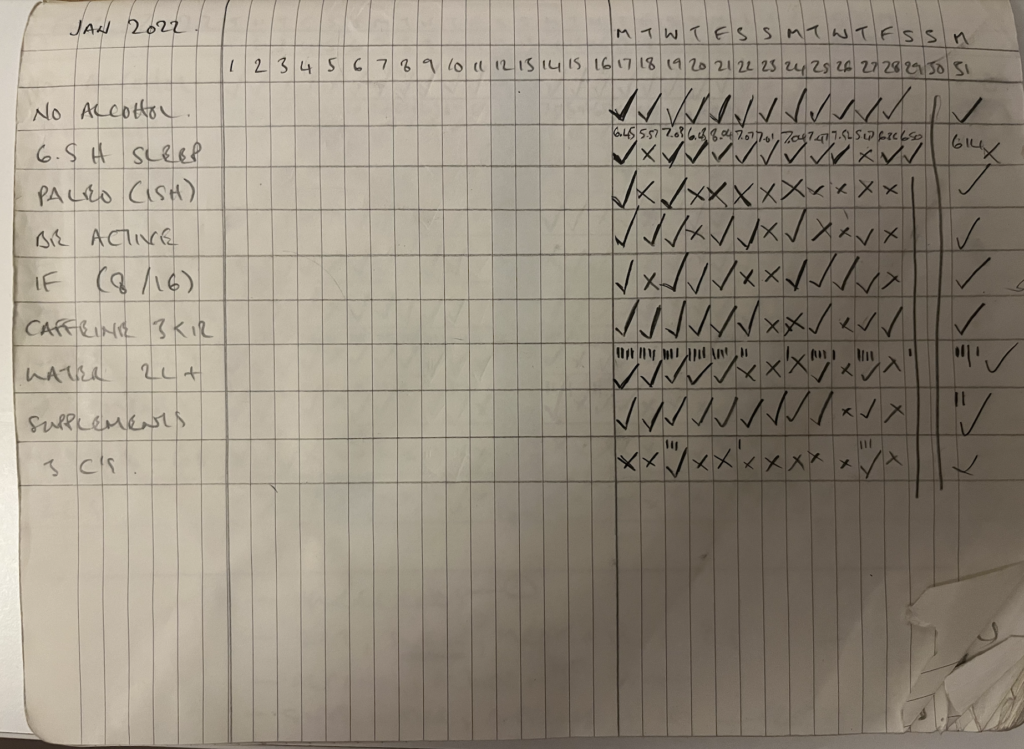

Think about this as more of an introduction, than an in depth guide. I’ll keep things pretty high level for now, and then I’ll cover each habit in a lot more detail in future posts / podcasts.

For now, I want to introduce each of the habits, explain why they are foundational, and also what I’m striving for with each one.

So let’s get started.

#1 Sleep

Sleep, hands down, is my most foundational health habit.

I often say that my foundational health habits are the base of the pyramid for me. Without that base in place, I really struggle to operate at a high level with anything in my life. But, when I’m consistent with these habits, the foundations are strong, and I’m incredibly high functioning – whether that is with fitness, work, my mental health, or just any part of my life.

One thing that I haven’t ever shared is that I often question whether sleep itself might actually be THE base of the pyramid – and then the other seven habits are actually all equally a second level of the pyramid. Sleep is literally that important – in itself – but also in how it influences how consistent I’m able to be with the other habits.

When I don’t sleep well for a few nights, everything else starts to fall apart. My discipline just starts to crumble. I end up skipping workouts. I snack on processed foods. Bad choices just start to muscle out the good choices in my life.

Maybe this is something you’ve noticed in your own life? Think about it. When you’re tired, do you find it harder to stick to good habits? I suspect the answer is, yes.

But, don’t just take my word for it. If you want to delve deeper into the relationship between sleep and will power, I’d encourage you to check out Dr Andrew Huberman’s podcast on How to Increase Your Willpower and Tenacity. [1] Huberman spends a whole section covering how sleep affects the autonomic nervous system, and how important a well balanced autonomic function is to be able to consistently generate will power.

Simply put, he says

‘When we’re not getting enough sleep, our capacity to call on tenacity and will power will be diminished’.

In fact, he goes so far to say, unless your autonomic function is working well, most other tools or protocols to try and improve willpower won’t make that much difference. Again, very similar to my base of the pyramid metaphor.

Of course, aside from how a lack of sleep wreaks havoc with discipline, there are many benefits to being a well slept, well rested person. I’ll get into these in the future. For now, just know, if you’re not getting enough sleep, you’re going to have a hard time keeping everything together – possibly even anything together. And your health is going to suffer big time.

And that’s why I have sleep as a foundational health habit, and why I hold it in the highest regard out of all of my habits.

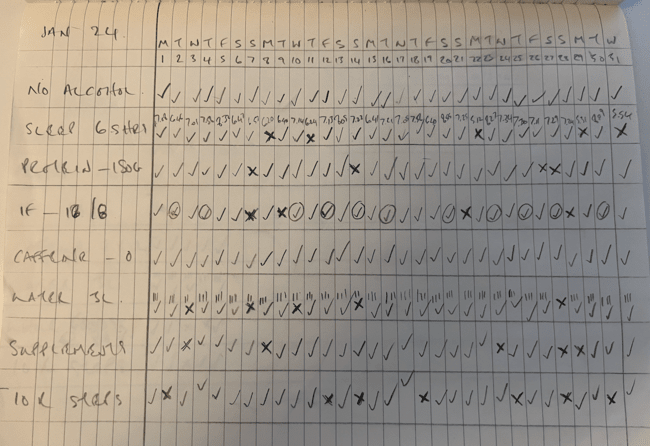

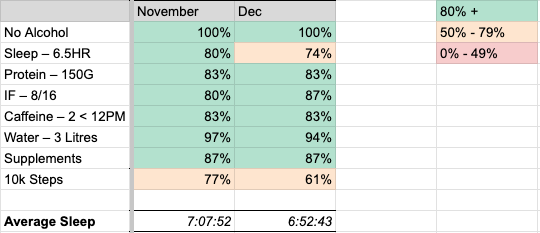

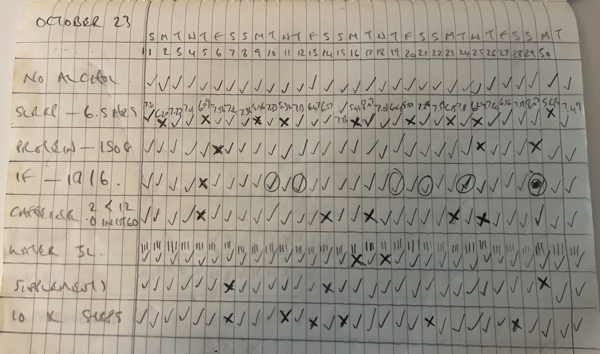

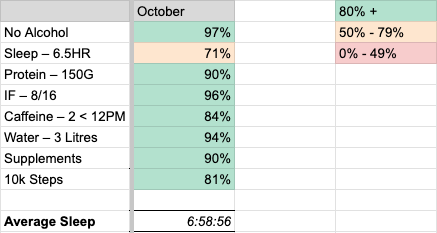

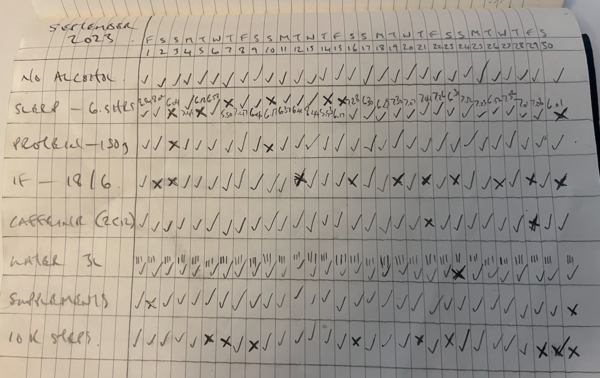

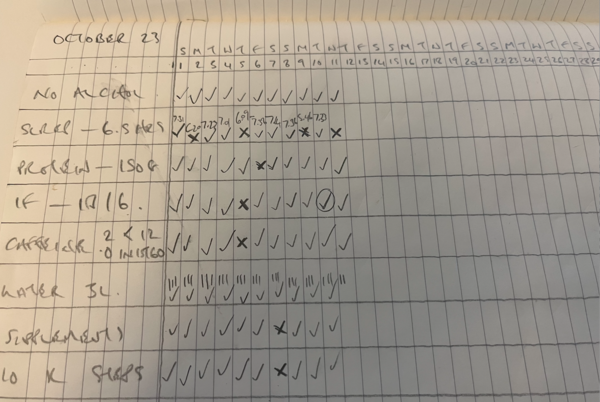

So, what is my goal when it comes to sleep? Personally, I shoot for six and a half hours. For me, that’s just a very clear line. Anything less than that, I feel it the next day. When I consecutively fall under six and a half hours for a few days? God, help me. It’s going to start getting messy.

I definitely want to progress that to seven hours at some point. I think that would be the sweet spot for me. But hey, one step at a time. I have quite a bit of work to do before I’m able to be consistent with six and a half hours.

#2 Alcohol

Alcohol is a huge deal. I have two main things to say on it.

The first, is that alcohol consumption is undeniably bad for your long-term health. There’s no shortage of studies that link alcohol consumption with an increased risk of cardiovascular disease and cancer.

There’s a really interesting study from Kiran Biddinger. [2] This study sets out to assess the link, not only between alcohol intake and cardiovascular disease risk – but also how different amounts of alcohol consumption affected that risk. And In short, the study found that consuming alcohol at all levels was associated with an increased risk of cardiovascular disease. So, yeah. very bad.

I know I’ve started off a bit gloomy when it comes to alcohol. But, there is actually a bit of good news with this study, which I’ll come back to in a minute. So, hang in there.

The second thing I want to say about alcohol, and this is particularly important when it comes to habits, is that it affects the quality of your sleep (you know, the habit I just talked about and consider the most important) – and not in a good way. Alcohol will fragment your sleep, and it also blocks you from getting into restorative phases of sleep. [3]

So, in short., If you’re going to prioritise sleep (and you should), alcohol is going to put one and a half hands behind your back.

I want to back that up with a real life example. Before I was sober, every time I would have a few drinks, my health metrics on my whoop band would be in the gutter the next morning . My resting heart rate would be sky high. My heart rate variability would be low. And my respiratory rate increased. I would always wake up with a low, red recovery score on my whoop app, telling me that my body wasn;t properly rested. The link between having a few drinks, and how my body was feeling the next day was just so clear to see.

And actually, here is an actionable thing you can do, to see it for yourself. If you don’t have a health wearable, try wearing one for a couple of weeks. You can grab a cheap fit bit, or like me, something more advanced, like a Whoop band. You will start to see a very obvious correlation between drinking the night before, and a set of horrible health metrics the next day.

And again, one of the biggest reasons for this, is that alcohol destroys the quality of your sleep.

So, in the same way that a lack of sleep will wreak havoc in my life, alcohol is arguably just as disastrous. And that’s why I have it as a foundational health habit.

As for my own goals with alcohol, that one is simple – I abstain from it entirely. I’ll definitely cover why I made that decision in a future post / podcast episode, watch this space.

Let’s get back to that piece of good news from the Kiran Biddinger study. One of the conclusions they drew was that whilst people who consume alcohol at low levels do have an elevated cardiovascular disease risk relative to those who abstain, this increase in risk is actually fairly small, and may even be mitigated or offset by other factors.

It’s not necessarily about completely abstaining – although to be clear, I do think that this is ultimately the best decision you can make for your long term health and to be able to stick to a set of foundational health habits. But, it’s at least about being mindful to have a low level of alcohol consumption – and you must set clear limits you can track your consistency against.

#3 Caffeine

Caffeine is a funny one because it has a range of positive and negative side effects. And actually, in the grand scheme of things, it seems as if most experts tend to err on the side of it being a net positive.

For example, it can help boost our brain function, our mood and our metabolism. It may even protect against heart disease, diabetes and a number of other diseases. However, it is also associated with anxiety, headaches, high blood pressure, irregular heartbeat, and trouble sleeping. [4]

It’s the trouble sleeping part that’s the reason I made it a foundational health habit for me. I want to do whatever I can to protect my sleep for the reasons we’ve already talked about.

Caffeine has a quarter life of 10-12 hours. What that means, is that if you have a coffee at midday, you can still expect about a quarter of it to be in your system at midnight. And we know for sure that caffeine is a sleep disruptor – like alcohol, it fragments your sleep and stops you getting into restorative phases of sleep.

For example, leading sleep expert, Professor Matthew Walker, points out:

Drinking just one dose of caffeine in the evening can decrease the amount of deep sleep by 20%. [5]

To put that in context, that type of reduction in deep sleep would usually happen as you age 15 years – that’s a big deal.

Now, it appears that we all have different levels of tolerance to caffeine. But on the whole, it’s sensible to limit both the amount of caffeine you consume, as well as when you consume it.

I limit my caffeine intake to a maximum of two cups per day, and never after midday. This tends to keep me on the right side of things for getting a good night’s sleep.

#4 Steps

The number of steps you walk per day is a really powerful habit, for a number of reasons.

When you commit to hitting a decent number of steps per day, you’re just an active person by default – regardless of what you do around it. And this is why it’s a foundational habit.

It’s so important, when I go on holiday, I pick only three health habits to stick to. Steps is one of those habits. Because at a baseline, it helps keep your head above water for being active.

It also happens to be the absolute easiest and most accessible form of exercise. I mean, virtually everyone is able to do it, and it’s free – I mean, you just have to go outside, and walk. It’s also very safe because it’s easy on the joints and therefore has a very low risk of injury – which makes it a perfect place to start if you want to have a more active lifestyle.

The other benefit to bringing in a habit of steps, is that it can be very effective for helping you lose weight. If you can commit to a decent number of steps per day, and even if you change nothing else, you are going to significantly increase the number of calories you burn every day. I’ve heard countless stories from people who have impressive weight loss stories, purely from only adding walking on a daily basis into their lifestyle. And not only that, it’s also a great addition to have, alongside a structured training program.

If all of that isn’t enough, check this out. There is a study on the lancet public health medical journal [6], that took a look at fifteen individual cohort studies. They found out that taking more steps per day was associated with a progressively lower risk of death. We’re not talking by a small margin either. Even getting your steps up to 5,800 steps per day, can help reduce one’s risk of death by 40%. And this increases as you increase your steps further. So, yeah – walking will make you live longer.

I shoot for 10,000 steps per day. That for me feels like the right amount of activity, when I consider the other forms of exercise I do.

#5 Protein

Most people don’t expect to see protein as a foundational habit – but let me explain why it has to be.

Building muscle should be an important goal of yours, no matter where you are in your fitness journey. Not only is it one of the keys to being a metabolically healthy and capable person now, it’s also a highly predictive metric of the quality of your life as you age, and how long you’re going to live.

I won’t get into the weeds for how protein builds muscle now – other than just say that when you consume protein, it is broken down into amino acids. Your body then uses these amino acids to create new muscle tissues.

So, to build muscle, you need to eat enough protein.

Building muscle aside, protein is also super useful for helping control the quantity and quality of the foods you eat – something which pretty much all of us find a challenge.

And that’s because firstly, protein is incredibly satiating. It can make you feel full and therefore helps you to eat fewer calories overall.

I’ll always remember listening to Greg Glassman, the founder of Crossfit talk about this in a nutritional seminar he gave.

It’s so true isn’t. Foods high in protein don’t make you feel like that. They just leave you satisfied.

The other thing about protein is that when you prioritise protein, it has this magical way of cleaning up your diet.

For example, let’s say you want some breakfast. If you think of protein first, you’re probably going to think of eggs. So, you drift towards making an omelet and chucking some other vegetables in it – or maybe some eggs with some sourdough, perhaps some avocado. When you don’t think of protein first, it’s all too easy to drift towards things like cereals, toast, or a pastry – all very low in nutritional value.

The same thing is true for lunch and dinner. When you prioritize protein, you tend to eat meats, potatoes, vegetables, and generally more whole foods. And when you don’t – it’s sandwiches, pastas, and stuff like that. Basically, more processed foods.

To summarise. Protein helps you build and maintain muscle mass. It also helps improve the quality of the foods you eat, and makes you less likely to overeat. And that’s why I have it as a foundational health habit.

The amount of protein we need is a bit of a controversial topic, and there is a wide range of opinions on it. I tend to listen more closely to experts who advocate for building lean muscle, people who look the part, and also tend to be very transparent about their health biomarkers. The advice from this crowd tends to be double the amount of grams for your body weight in KG.

For me, that equates to 150 grams of protein – so that’s the target I set for myself.

#6 Fasting

Like protein, on the surface, fasting feels an odd habit to have as a foundational health habit. But let me explain why it’s here.

Fasting really forces a healthier, and more intentional relationship with food. When you go through periods where you’re either allowed, or not allowed to eat – it’s now on your terms. You set the rules.

You start to realise, it’s OK to feel a little hungry and not react immediately. You’re in control – it now becomes an intentional and conscious process. This is actually very different to how the vast majority of people eat – where food is just always around us and up for grabs.

The other thing about fasting is that it generally helps you to better control your calorie intake – something which alot of us struggle with, and ends up leading to weight gain and other health issues. Fasting helps with this because you’re eating in a smaller time window. So, it just stands to reason – with less time available to eat, you tend to eat less.

I’ve found fasting incredibly powerful to regain control over my relationship with food and maintain a healthier body weight.

My target for fasting is 16 / 8, which is commonly referred to as intermittent fasting. It means a 16 hour fasting period, and an 8 hour eating period. I do this by skipping breakfast and usually eating between around 1PM though 9PM every day.

#7 Water

Being well hydrated is a fairly big deal – which is why I consider it a foundational health habit.

You’d be surprised how broad the benefits are to being well hydrated – and particularly how being dehydrated can negatively affect some of the other foundational health habits.

I like to think of the impact of being well hydrated in three main buckets. Two are specific, and one is related to the broader impact it has on my other foundational habits.

The first bucket is cognitive performance. Even slight levels of dehydration can make you feel fatigued and give you brain fog. But, when you’re well hydrated, you engage your sympathetic nervous system, which in turn helps increase your energy, focus and this helps to reduce brain fog. In short, you’re going to be sharper.

The second bucket is physical performance. It’s well proven that being well hydrated increases your performance when you’re exercising. And who doesn’t want the best bang for buck from your efforts in the gym? This can make a meaningful difference to your results over the mid to long-term.

The third bucket is the broader impact it has on my other foundational habits. There are alot of cellular processes in the body that rely on having the proper electrolyte balance – that’s enough sodium, magnesium and potassium. When these are off, it can really mess with your digestion, your cognitive performance and even your sleep. When you drink enough water and keep yourself hydrated, you’re much more likely to have a proper electrolyte balance.

So, how much water do I drink?

There’s no exact science in determining exactly how much water you should drink – and it can depend on a bunch of factors. Things like how active you are, whether you’re exposed to heat etc.

I ended up coming to my own number by listening to Dr Andy Galpin – who is a well respected authority in the health and fitness space. His recommendation is super straight forward.

Aim for half an ounce of fluid, per pound of bodyweight, per day. I weigh 175 lbs, so that equates to 88 fluid ounces. When you work that back into liters, you get to 2.5 liters. I then rounded that up to 3 liters to be safe.

#8 Whole Foods

Whole Foods is actually a new habit that I brought in only this month. That’s because, over the last few months I’ve been getting a growing feeling that I need something to bolster the nutrition side of things, and to hold me accountable for better food choices.

When I eat a diet mostly consisting of whole foods, it becomes much easier to be in good health, control my weight and build lean muscle. Quite frankly, I just feel amazing when I’m eating mostly whole foods.

On the flip side, when I’ve been in periods of eating a lot of ultra processed foods, the opposite is true. I get sick, I struggle with my weight – and I just feel lousy.

What do I mean by whole foods? Foods that tend to have one ingredient, and haven’t been heavily processed – so stuff like meat and fish, vegetables, fruit, nuts, milk, eggs, potatoes, oats etc.

That means avoiding foods outside of that definition, which I’ll call either processed or ultra processed foods. These are foods that tend to have over five ingredients in them. They usually come in packages and they usually have a long-shelf life. So, think of the obvious stuff like ready meals, cakes, biscuits, ice creams, chocolate bars – but even things not quite so obvious like fruit flavored yogurts, instant soups, fizzy drinks, mass produced white bread, breakfast cereals and bars etc.

Whilst I’ll cover the whole food topic in more detail in future episodes, for now I would recommend a really great documentary called the Magic Pill on Netflix [7]. They take a handful of different types of people struggling with health problems, and they put them on a paleo diet for 30 days – fruits, vegetables, lean meats, fish, eggs, nuts and seeds. Very close to the whole food definition.

In just 30 days, a lot of their health problems are reversed. It really highlights the power of making good food choices. It’s well worth a watch.

My goal when it comes to whole foods is to have 80% of my calories be whole foods – allowing myself 20% leniency. Having this as a daily habit that I track is already highlighting how much work I have to do. I’m going to come in at less than 50% consistency for the month of February – so, watch this space for future improvements!

There you have it. My eight foundational health habits – Sleep, Alcohol, Caffeine, Step, Protein, Fasting, Water and Whole Foods.

When you figure out how to keep these things in check most of the time – you’re going to be a completely different human being. You’re going to build that solid base of the pyramid I talked about at the beginning of this episode.

Of course, it’s one thing knowing that, and it’s another thing being able to do it.

Luckily for you, that’s why I write about foundational habits, and why I started The Daniel Clough Podcast. I’m looking forward to sharing more about these habits with you over the coming months, especially some of the strategies that will help you build foundational health habits into your own life.

Notes:

[1] How to Increase Your Willpower & Tenacity | Huberman Lab Podcast (this link jumps right to the segment on Autonomic Function, Tenacity & Willpower, Sleep & Stress)

[2] Association of Habitual Alcohol Intake With Risk of Cardiovascular Disease

[3] Effects of Alcohol on the Body: Data Insights for HRV, Sleep & More

[4] What Is Caffeine, and Is It Good or Bad for Health?

[5] Sleep Expert REVEALS How Caffeine DESTROYS Your Sleep & Productivity! | Matthew Walker

[6] Daily steps and all-cause mortality: a meta-analysis of 15 international cohorts

Get my ideas straight to your inbox. Sign up for my newsletter below: